collection for the tax authority; however, of more vital importance is the need to enable this without having an unacceptable detrimental effect on the other key characteristics of a well-designed tax system (equity, wider administrative efficiency etc). This requires the development of public awareness of tax laws, and improvements in voluntary PhDs in Business & Management Taxation refers to the practice of collecting money from citizens and trading companies by government institutions, in order to finance public institutions, goods and services. Taxation degrees use knowledge from areas such as economy, legislation, politics, public administration and international business to taxation is however inconclusive in the case of developed economies and sparse in relation to LDCs. This thesis examines the impact of taxation on business in LDCs at the level of the individual business firm, using the survey technique supported by content analysis and ratio analysis of published material. The study is carried out with particular reference

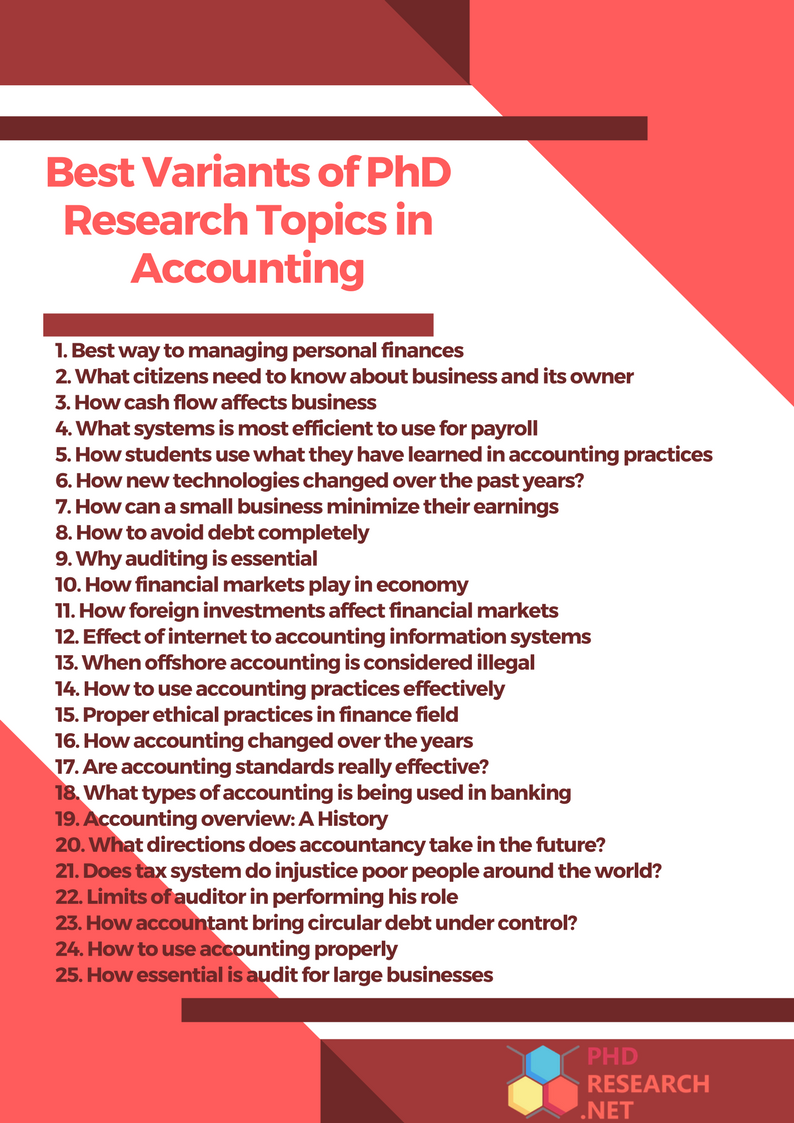

20 Tax Dissertation Topics to Be Useful for Your Audience in the Future | blogger.com

Bennett, Piyaseeli Effects of taxation on business in less developed countries with special reference to Sri Lanka, phd taxation thesis. PhD phd taxation thesis, University of Warwick. Request Changes to record. Taxation today plays a major role in economic activity, as the prime source phd taxation thesis revenue and as a tool of economic management for government and as a major recurrent outgoing for business firms and households.

Theoretical analysis of the impact of new taxes or changes in taxation is usually conducted with reference to investors and business firms exercising 'rational' profit or present value maximising behaviour under conditions where all other relevant factors remain unchanged.

Empirical evidence on business response to taxation is however inconclusive in the case of developed phd taxation thesis and sparse in relation to LDCs. This thesis examines the impact of taxation on business in LDCs at the level of the individual business firm, using the survey technique supported by content analysis and ratio analysis of published material.

The study is carried out with particular reference to Sri Lanka, a phd taxation thesis LDC, but the findings are also supported by analysis of business opinion in two other developing countries. A separate examination is undertaken of the perceptions of and responses to taxation of MNC business operating in LDCs. The research results lead to three main conclusions. Firstly, the perceptions of business relating to taxation are seen to be non-uniform and for the most part are related to organisational characteristics of the business entities.

Secondly, business response to taxation does not always correspond with rational profit maximising behaviour on the part of business managers. Liquidity objectives appear to be at least as important. Finally, perhaps the main conclusion drawn from the research findings is that the impact of taxation on business decisions is small and that taxation is not by any means a major constraint on business development; the main reason being the presence of other more restrictive environmental influences.

Request changes or add full text files to a record. Email us: wrap warwick. uk Contact Details About Us. Skip to content Skip to navigation. Study Research Business Alumni News About.

The Library. Login Admin. Effects of taxation on business in less developed countries with special reference to Sri Lanka. Downloads per month over phd taxation thesis year. pdf - Submitted Version Download 19Mb Preview, phd taxation thesis. Taxation -- Sri Lanka, Taxation -- Developing countries, Business enterprises -- Developing countries -- Finance, Economic development -- Sri Lanka, phd taxation thesis, Surveys. Date Event October

PhD Dissertation: Tips On Editing A Dissertation / Thesis ( PhD Thesis Writing Tips In Business )

, time: 10:27Unique Dissertation Topics on Taxation - Free & Updated

Nov 27, · Taxation is the process of paying certain sums of money for the government in order to maintain the proper living conditions in the country. Taxes are imposed by government to provide people with up-to-date well-developed communication and transport systems, sewers, electricity, gas, water, security, the services of the police, firemen, health care and nearly everything a modern person Estimated Reading Time: 4 mins This thesis examines the relationship between taxes and economic growth. Since the rise of supply side economics in the ’s as a doctrine for understanding macroeconomics, many claims have been made regarding a connection between the rates and amount of taxes collected and subsequent economic growth or decline. This thesis The purpose of this study was to develop a conceptual framework to aid in the reduction of the taxation gap in South Africa (SA) through the use of third-party data and information technology. In order to develop a framework The perception of tax practitioners relating to the influence of the Tax Administration Act on taxpayers' tax

No comments:

Post a Comment